As the world delves deeper into the digital age, Bitcoin continues to headline as a revolutionary player in the financial landscape. The latest milestone, known as the Bitcoin halving, occurred with bated breaths and keen eyes from the global community. This event, central to Bitcoin’s economic model, not only affects miners but also sends ripples across the entire cryptocurrency market, influencing pricing, mining practices, and even environmental considerations.

The Mechanics of Bitcoin Halving

Bitcoin halving is a predetermined event that occurs every four years, effectively slashing the rewards that miners receive for verifying transactions and adding them to the blockchain by half. This process is crucial as it directly impacts the influx of new bitcoins into the market, thereby manipulating scarcity and demand. Originally set in motion by Bitcoin’s elusive creator, Satoshi Nakamoto, halving is designed to maintain the currency’s inflation rate and ensure its longevity by mimicking the extraction of precious resources—gradually reducing the supply to increase or stabilize value over time.

The concept of halving is simple: it reduces the reward for mining new blocks from 6.25 bitcoins to 3.125 bitcoins. This reduction has a dual effect; it decreases the rate at which new bitcoins are generated and underscores the cryptocurrency’s deflationary nature. The total number of bitcoins that can ever exist is capped at 21 million, a figure that the Bitcoin protocol strictly enforces to prevent inflation.

Historical Impact and Market Speculations

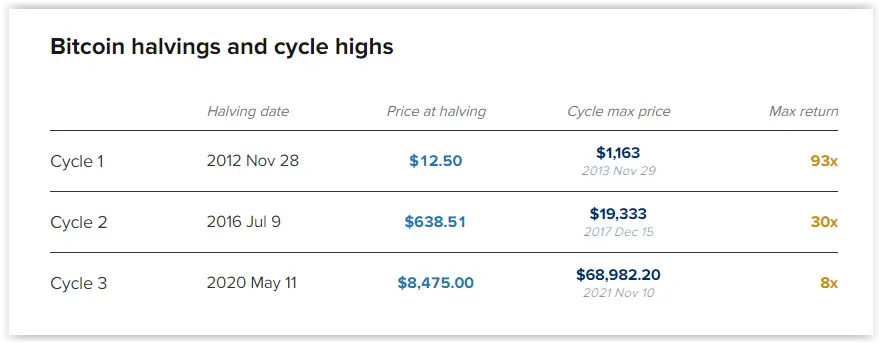

The anticipation around halving often leads to speculative increases in Bitcoin’s price. Historical data from previous halvings in 2012, 2016, and 2020 shows substantial price increases post-event, although these gains were not immediate and took months to materialize. For instance, the halving in May 2020 saw Bitcoin’s price catapult from around $8,602 to nearly $57,000 by May 2021. These patterns suggest a bullish outlook, but as every seasoned investor knows, past performance is not always indicative of future results.

This latest halving has not deviated from raising expectations. With the price of Bitcoin already having experienced significant upswings in the months leading up to the halving, market analysts and investors were keenly watching to gauge the “halving effect.” Experts like Ryan Rasmussen of Bitwise suggest potential gains could soar, with estimates ranging wildly between $100,000 and $400,000. However, skepticism remains, with institutions like JPMorgan cautioning that the benefits of halving may already be priced into the market.

Challenges and Opportunities for Miners

The reduction in block rewards presents a considerable challenge for Bitcoin miners, who are forced to reassess their operational strategies and efficiency. Post-halving, miners face a drop in profitability unless countered by a surge in Bitcoin’s price. This necessitates advances in mining technology, optimization of energy consumption, and possibly, a migration towards more cost-effective regions. The event could trigger a wave of consolidation in the industry, phasing out less efficient miners and reinforcing the position of larger, more established entities.

Environmental Concerns and the Future of Mining

Beyond economics, the halving event casts a spotlight on the environmental impact of Bitcoin mining. The crypto mining process is notoriously energy-intensive, and the industry has been critiqued for its substantial carbon footprint. With the growing emphasis on sustainable practices, the industry is gradually shifting towards renewable energy sources. However, the full environmental impact of the latest halving is yet to be determined, with ongoing debates about the balance between technological advancement and ecological responsibility.

Looking Ahead

The halving phenomenon embodies the unique economic model of Bitcoin, intertwining market dynamics with technological innovation. As the industry evolves, the implications of halving will extend beyond mere economics, influencing global financial policies, mining practices, and even environmental strategies. Whether this halving will follow the historical trend of bullish outcomes remains to be seen, but the event undoubtedly marks a significant epoch in the cryptocurrency narrative.